Injective (INJ) Price Breaks Resistance, Eyes 4.5x Rally Amid Institutional Growth

TLDR: Injective broke above a long-term downtrend, turning its market structure bullish. Analysts predict a move from $12.81 to $53.57, targeting INJ’s all-time high. Partnerships with Google Cloud and Deutsche Telekom boost Injective’s validator network. Injective integrates AI agents via OpenAI, expanding real-world utility for trading and DeFi. Injective Protocol has emerged as a standout [...] The post Injective (INJ) Price Breaks Resistance, Eyes 4.5x Rally Amid Institutional Growth appeared first on Blockonomi.

TLDR:

- Injective broke above a long-term downtrend, turning its market structure bullish.

- Analysts predict a move from $12.81 to $53.57, targeting INJ’s all-time high.

- Partnerships with Google Cloud and Deutsche Telekom boost Injective’s validator network.

- Injective integrates AI agents via OpenAI, expanding real-world utility for trading and DeFi.

Injective Protocol has emerged as a standout performer in the crypto market, with analysts identifying bullish patterns that could drive substantial price gains.

The blockchain project has demonstrated resilience while many altcoins struggled, breaking key resistance levels and establishing new support zones. Market sentiment around INJ has shifted notably positive, with traders highlighting the token’s technical strength and fundamental developments.

Current price action suggests the cryptocurrency may be positioned for an upward move in the coming weeks. Indicators point to a potential multi-fold increase that could take INJ back to previous highs.

Injective Price Breaks Key Resistance Levels

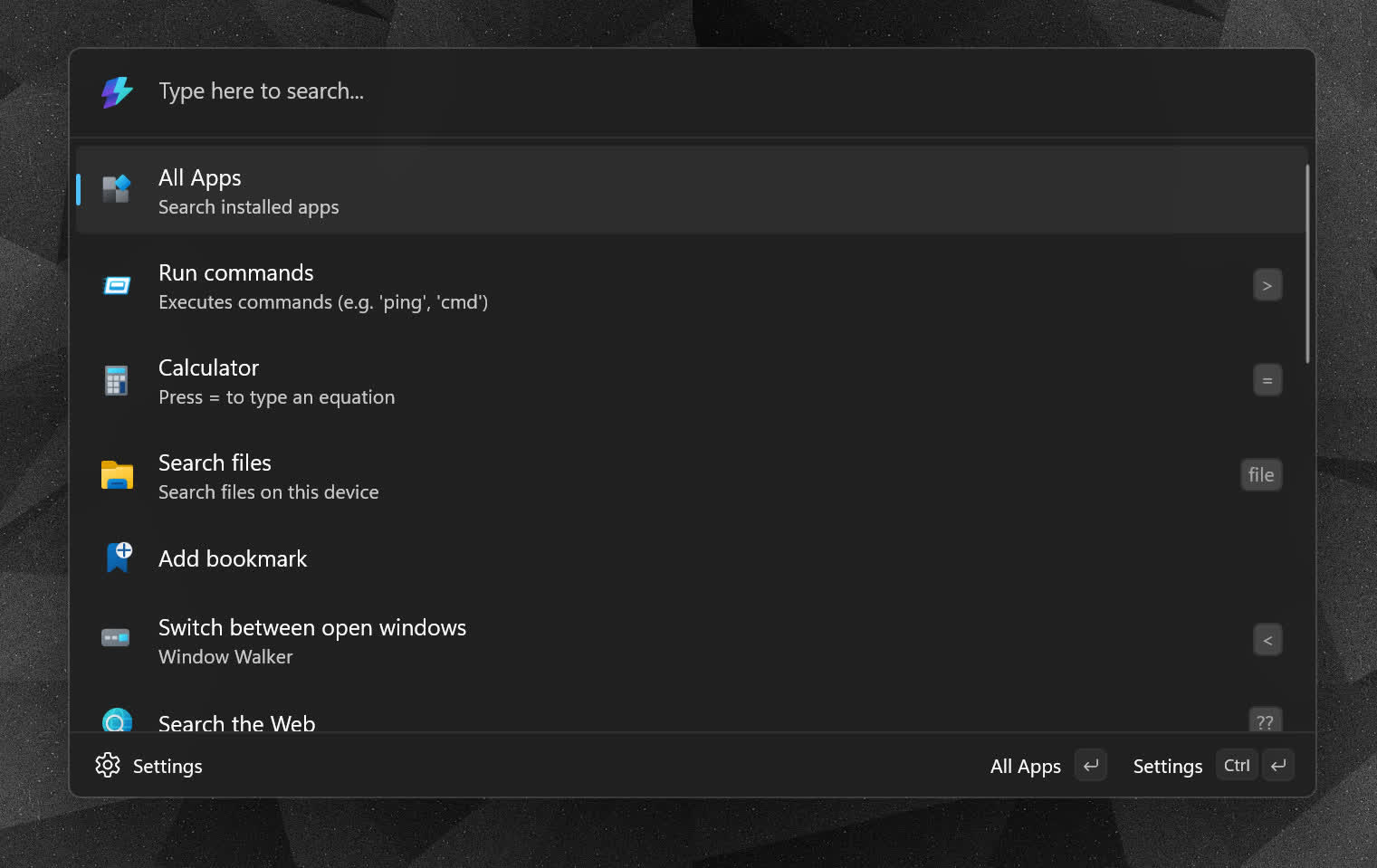

Price analysis reveals that Injective has successfully broken above a major downtrend line that had been suppressing the token’s value.

Crypto analyst Lennaert Snyder identified a rounded bottom formation developing between mid-2024 and early 2025. This typically signals a long-term trend reversal from bearish to bullish territory.

$INJ at these prices feels like an absolute steal.

Printed a strong weekly gain, breaking the HTF downtrend.

While other altcoins took a hit, $INJ showed no signs of weakness.

Insanely strong fundamentals, continuously cooking.

Easy 4,5x to the highs. @injective

pic.twitter.com/1eZXhYeyQK

— Lennaert Snyder (@LennaertSnyder) June 3, 2025

The breakout above the high-timeframe downtrend resistance marks a crucial shift in market structure, turning the overall bias bullish after an extended period of decline.

The technical setup shows INJ establishing strong support around $9.98, which previously acted as resistance before the breakout occurred. This level now serves as a foundation for potential upward movement. The next major resistance target sits near $53.57, representing the token’s previous all-time high.

Snyder’s analysis suggests this could translate to approximately a 4.5x gain from current levels, projecting a move from around $12.81 to the $53.57 target zone.

Short-Term INJ Price Targets Show Bullish Momentum

Trader Dennis has identified more immediate price targets for INJ. He noted that the token recently bounced from $15 resistance and established solid support at the $12 level.

His analysis of shorter timeframe charts indicates strong momentum building for a move toward $20 soon. The formation of this support base at $12 provides a launching pad for the next leg higher, with technical indicators suggesting continued upward pressure.

Current market data from CoinGecko shows INJ trading at $12.91. The token’s 24-hour trading volume is $116.6 million, representing a 4.01% increase in the last day.

Despite a 13.71% decline over the past week, the token has maintained its technical structure. Moreover, it has shown relative strength compared to other altcoins during market downturns.

Technical sentiment indicators currently read neutral. The Fear and Greed Index shows a reading of 62, indicating greed levels that often precede significant price movements.

Injective Fundamental Developments Drive Long-Term Outlook

Beyond technical analysis, Injective has made substantial progress in expanding its ecosystem and institutional adoption over the past six months.

According to analysts at Crypto Busy, the protocol has integrated artificial intelligence capabilities through partnerships with the Artificial Superintelligence Alliance. This provides users access to autonomous agents and enhanced trading experiences.

These developments include the launch of the iAgent framework powered by OpenAI and the upgraded iAgent 2.0 with cross-chain AI agent communication capabilities.

Injective $INJ is positioning itself as one of the most comprehensive AI-powered DeFi infrastructure chains in crypto.

In the past 6 months (November 2024 to May 2025), @injective has shipped some of the most significant updates across AI, DeFi, TradFi integration, and… pic.twitter.com/XzrE9BJKp6

— CryptoBusy (@CryptoBusy) June 4, 2025

Institutional adoption has accelerated, too. Major validators, including Hex Trust, Korea Digital Asset Custody, Deutsche Telekom MMS, and Google Cloud, have joined the network.

These partnerships bring enterprise-grade infrastructure and institutional exposure to both European and Asian markets. The addition of Republic as a validator has further strengthened the network’s institutional-grade staking infrastructure.

Injective has launched key products bridging traditional and decentralized finance, including the TradFi Index for stock-based perpetual markets and liquid staking via TruFin and Republic. Its iAssets framework tackles settlement delays and regional limits, while a native EVM layer with Multi-VM support boosts cross-platform development.

The post Injective (INJ) Price Breaks Resistance, Eyes 4.5x Rally Amid Institutional Growth appeared first on Blockonomi.