Mutuum Finance (MUTM) Builds Quiet Momentum Below the Radar As Bitcoin (BTC) Traders Debate $94K or $114K

Bitcoin (BTC) is currently trading at around $103,800, with a sharp split in sentiment between bears and bulls. Recently, the Fear & Greed Index for BTC fell to 37, below the psychological 40 mark. This is driven by rising anxiety in the crypto market over a possible escalation of military actions in the Middle East. [...] The post Mutuum Finance (MUTM) Builds Quiet Momentum Below the Radar As Bitcoin (BTC) Traders Debate $94K or $114K appeared first on Blockonomi.

Bitcoin (BTC) is currently trading at around $103,800, with a sharp split in sentiment between bears and bulls. Recently, the Fear & Greed Index for BTC fell to 37, below the psychological 40 mark. This is driven by rising anxiety in the crypto market over a possible escalation of military actions in the Middle East.

According to the bears, if conflict in the Middle East escalates, the price of BTC could drop to around $94k. However, the bears believe that the price of BTC could rise to $114k. However, some believe that if there is a conflict, BTCD could start rising. While it may experience some shocks in the initial phases, it will most likely gain momentum once a conflict is well underway. They point to the rise of BTC, which experienced a massive dip after the Ukraine-Russian conflict but then pumped over 40% barely a month into the conflict.

No matter what side of the argument you are on, it is quite clear that there will not be massive gains for BTC in the future. A major reason for this is that BTC has matured as an asset, and the error of double-digit growth is ending.

As such, investors are looking into promising projects with low pricing that are poised for massive gains. One such project is Mutuum Finance (MUTM), which has been getting massive attention from investors in recent weeks.

Analysts have put out optimistic forecasts for the future of MUTM tokens, and investors have been paying attention. The project’s presale has seen massive participation numbers and huge amounts of capital raised in record time.

MUTM Token Presale: A Blazing Success

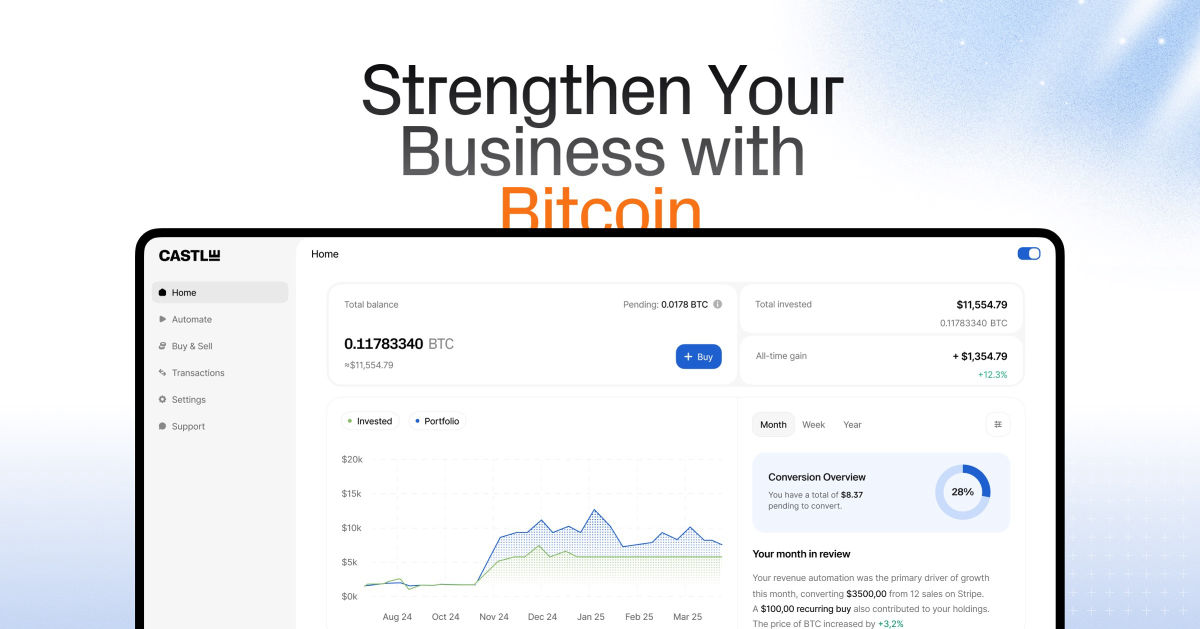

Mutuum Finance (MUTM) is currently in phase 5 of the presale, where over $11.2 million has been raised so far. Around 12,450 unique buyers are participating in the presale, which is currently in phase 5. In the current phase of the presale, tokens are going for $0.03, a 200% increase from the phase 1 price of $0.01.

The token price is set to go up by 16.67% in the upcoming phase 6 to $0.035, and this process is expected to continue until the final listing price of $0.06. With the tokens currently available at a 50% discount, they have been selling at a blazing speed.

So far, 50% of the tokens set aside for phase 5 of the presale have been sold less than a month after they launched. This speed is expected to continue until the final token is sold in phase 5 as investors rush to secure their tokens at a guaranteed ROI of 100% based on the planned listing price. In the upcoming phase 6, the ROI will reduce to 71.43%.

Another reason why the participation pace is rising is due to the ongoing $100,000 giveaway. The Mutuum Finance (MUTM) team plans to give away $10,000 worth of MUTM tokens to ten lucky winners each. To receive these rewards, all you need to do is participate in the ongoing presale with a minimum purchase of $50.

Mutuum Finance (MUTM) Protocol Framework

Mutuum Finance (MUTM is a DeFi lending protocol that allows users to participate in the protocol as lenders, liquidators, or borrowers. Lenders on the protocol deposit their assets in the liquidity pools in exchange for interest.

Assets supplied by lenders can be obtained by borrowers via overcollateralized loans by supplying sufficient collateral. The lenders deposit assets in a communal pool secured using a smart contract, and borrowers can access the pool by supplying collateral. There is no individual loan matching requirement, and it operates based on a collective pool.

The interest rates for lenders and borrowers are adjusted by the market conditions. For borrowers, the rate is tied to the utilization rate. When there is a high amount of assets borrowed, the rate rises. This process ensures balanced use of capital in the pools.

Meanwhile, yields for lenders are based on borrowers’ interest payments, and a reserve factor designed to guarantee access to liquidity. To maintain liquidity buffers, lenders always have access to their deposits, and they can redeem them by depositing mtTokens that they receive in exchange for their funds.

The system ensures that those who supply capital to the protocol are rewarded, while at the same time ensuring there is enough on-chain liquidity for borrowers in the ecosystem. For example, when a lender supplies $10,000 in USDT to a pool with a high utilization rate, the APY could rise to 14%. That means they will receive $1,400 on their assets per year. This system does not require knowledge of advanced trading strategies, creating a convenient and safe method to earn passive income.

Conclusion

Mutuum Finance (MUTM) is an exciting Defi project that is built to benefit all users of the protocol. It has numerous safety mechanisms in place that will ensure it attracts a massive user base. At the center of this budding ecosystem is the MUTM tokens, which are currently available at a 50% discount. You could stand to make massive returns if you join the presale now.

For more information about Mutuum Finance (MUTM), visit the links below:

Website: https://www.mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

The post Mutuum Finance (MUTM) Builds Quiet Momentum Below the Radar As Bitcoin (BTC) Traders Debate $94K or $114K appeared first on Blockonomi.