XRP (XRP) Price: Standard Chartered Forecasts $12.5 Value by 2028

TLDR Standard Chartered projects XRP could reach $5.5 by end of 2025 and $12.5 by 2028 Ripple’s focus on cross-border payments cited as key growth catalyst XRP realized cap has doubled from $30.1B to $64.2B in recent months 62.8% of XRP’s invested capital comes from investors who entered in the last six months Options market [...] The post XRP (XRP) Price: Standard Chartered Forecasts $12.5 Value by 2028 appeared first on Blockonomi.

TLDR

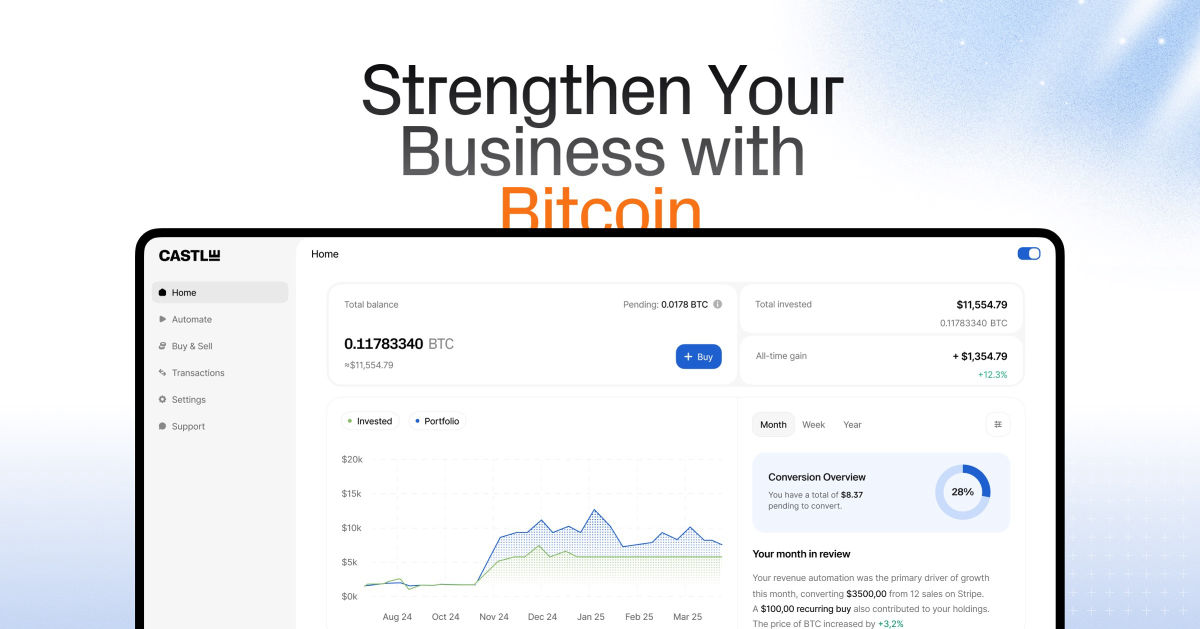

- Standard Chartered projects XRP could reach $5.5 by end of 2025 and $12.5 by 2028

- Ripple’s focus on cross-border payments cited as key growth catalyst

- XRP realized cap has doubled from $30.1B to $64.2B in recent months

- 62.8% of XRP’s invested capital comes from investors who entered in the last six months

- Options market shows 4.5% chance of XRP hitting $4 by next month

XRP, the cryptocurrency associated with Ripple, has caught the attention of major financial institution Standard Chartered with bold price predictions for the coming years. According to a recent report by the bank, XRP could experience substantial growth, potentially reaching $5.5 by the end of 2025 and climbing to $12.5 by 2028.

This would represent a 600% increase from its current value of around $1.7, continuing the strong performance that followed the 2024 U.S. presidential election.

The price prediction comes as on-chain data shows a major shift in XRP’s investor base, with new investors now holding the majority of the cryptocurrency’s realized capital.

Standard Chartered released its report on April 8, outlining several factors behind their bullish outlook. The bank noted that XRP has already seen sixfold returns following Donald Trump’s election victory in November 2024.

According to the bank, this rally was driven by expectations of a regulatory shift and the potential dismissal of the Ripple lawsuit under the Trump administration.

Cross-Border Payment Potential

Geoffrey Kendrick, head of digital asset research at Standard Chartered, highlighted Ripple’s unique position in the cryptocurrency market. “XRP is uniquely positioned at the heart of one of the fastest-growing use cases for digital assets – facilitation of cross-border and cross-currency payments,” he stated in the report.

Kendrick further explained the practical applications of XRP, comparing it to stablecoins like Tether. “XRPL is similar to the main use case for stablecoins such as Tether: blockchain-enabled financial transactions that have traditionally been done through traditional financial institutions.”

Ripple has made strategic moves to strengthen this position, recently acquiring Hidden Road, a traditional prime broker that handles $10 billion in daily trades. The acquisition aims to accelerate transactions via XRPL by leveraging XRP and Ripple’s stablecoin RLUSD.

Brad Garlinghouse, Ripple’s founder, explained the benefits: “Instead of waiting for <24 hours to settle trades through fiat rails, Hidden Road will be using XRPL for clearing a portion of trades, and using RLUSD as collateral across its prime brokerage services.”

Today, @Ripple announced the acquisition of Hidden Road for $1.25B, one of the largest deals ever in the crypto space. But the price tag isn’t what’s most important – it’s that this deal marks a once-in-a-lifetime opportunity for crypto to access the largest and most trusted…

— Brad Garlinghouse (@bgarlinghouse) April 8, 2025

New Investors Dominate

While Standard Chartered’s outlook remains positive for the long term, on-chain data from Glassnode reveals interesting shifts in XRP’s investor composition. The realized cap, which tracks the total capital invested in the cryptocurrency, has doubled from approximately $30.1 billion to $64.2 billion in recent months.

This sharp increase has been driven primarily by new investors. According to Glassnode, investors who entered the market in the last six months now control 62.8% of XRP’s realized cap, up from just 23% prior to the recent inflows.

Glassnode described this as a sign of “retail-led momentum,” noting that the growth rate has slowed recently. The analytics firm warned that this concentration of new holders “reflects strong retail involvement – but also raises the risk of fragility, as many hold elevated cost bases.”

This situation mirrors conditions that preceded market tops during previous bull cycles. With many of these new investors potentially underwater on their investments and inflows slowing, some caution may be warranted despite the optimistic long-term outlook.

The short-term market sentiment appears mixed. Options market data indicates just a 4.5% probability of XRP reaching $4 by next month. However, the $4 call option was the most actively traded in the 24-hour period, suggesting some traders believe the cryptocurrency could reach a new all-time high by May.

Like many cryptocurrencies, XRP faces short-term pressure from broader market uncertainty. Recent price action shows volatility, with the token falling back to $1.78 after a decline of more than 8% in a 24-hour period.

For investors considering XRP, the contrast between Standard Chartered’s long-term optimism and Glassnode’s warning about investor composition presents an interesting dynamic. The cryptocurrency’s focus on solving cross-border payment challenges remains a compelling use case, while the current investor structure suggests potential short-term volatility.

XRP’s future may depend on how successfully Ripple continues to expand its cross-border payment solutions and navigate the changing regulatory landscape under the current administration.

The post XRP (XRP) Price: Standard Chartered Forecasts $12.5 Value by 2028 appeared first on Blockonomi.