I started using Experian IdentityWorks for online protection and haven't looked back

Experian IdentityWorks protects users from potential identity theft with extensive daily scans and alerts.

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

Every discussion about Experian IdentityWorks in reviews and news begins with the mandatory mention of the company's previous data breach history. This evaluation contains the same pattern as others, but readers should evaluate its complete fairness. The brand IdentityWorks operates under Experian, which maintains its position as a subsidiary, despite Experian’s well-known reputation for negative reasons.

In 2015, the major consumer credit reporting agency revealed one of the most significant data breaches, which exposed more than 15 million customer records. The massive security failure of a credit reporting agency handling sensitive financial data caused global shock and widespread public concern, despite additional data breaches across various industries.

The infamous security incident occurred more than ten years ago. The long duration of this event would remind movie fans of a memorable scene from The World According to Garp. The movie depicts Robin Williams' character, who searches for a house but watches a plane crash into his potential home. He decides to buy the house because he believes another plane hitting the house would be astronomically unlikely.

The security measures implemented by Experian follow a similar pattern to the previous situation. The company likely dedicated significant resources to improving data security after its major and harmful 2015 data breach, thus surpassing other organizations in their security enhancements. Experian faces an "astronomical" probability of experiencing another major data breach at least as severe as its previous incident. The focus on Experian's 2015 breach creates an inaccurate impression because the company has probably developed enhanced defensive capabilities that provide better protection for its IdentityWorks users today.

Reader Offer: Save up to 50% on Aura identity theft protection

TechRadar editors praise Aura's upfront pricing and simplicity. Aura also includes a password manager, VPN, and antivirus to make its security solution an even more compelling deal. Save up to 50% today.

Preferred partner (What does this mean?) View Deal

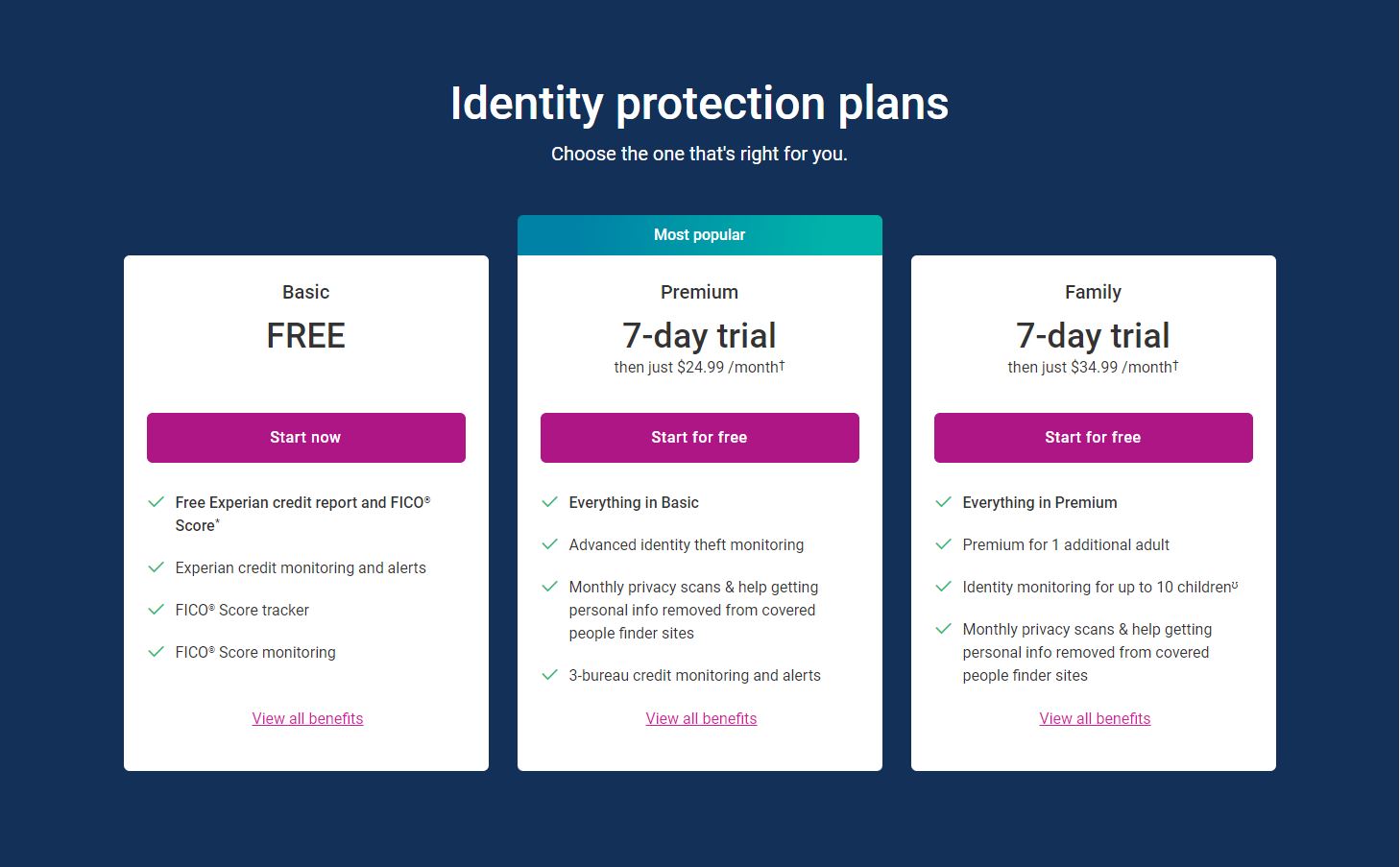

Experian IdentityWorks: Plans and pricing

The Basic plan, a free tier of Experian, offers limited features. It includes a complimentary Experian credit report, FICO score, dark web surveillance report, and FICO score tracker. While cost-effective, this plan provides minimal protection.

The Premium plan offers a comprehensive range of features designed to protect adults from identity theft and fraud. Priced at $24.99 per month, this subscription service provides robust monitoring and alerts to safeguard sensitive personal information.

One of the key features of the Premium plan is full access to credit monitoring. This service monitors your credit reports from the three major credit bureaus—Experian, Equifax, and TransUnion—and notifies you of any changes or suspicious activity. This allows you to stay informed about your credit profile and quickly identify any potential issues, such as unauthorized inquiries or fraudulent accounts.

To enhance account security, the plan offers financial account takeover alerts. These alerts vigilantly monitor your financial accounts for any unauthorized transactions or changes. By doing so, this feature safeguards your bank accounts, credit cards, and investment accounts against potential compromises. If any suspicious activities are detected, you will receive immediate notifications, allowing you to take prompt action to secure your accounts effectively.

Within the Premium plan's robust offerings, change of address alerts stand out as a crucial feature. This service keeps a watchful eye on public records to detect any modifications to your address, such as alterations to your driver's license or voter registration. Identity thieves frequently exploit change of address requests to reroute your mail, allowing them to pilfer confidential documents. However, this alert system safeguards you by promptly notifying you of any unauthorized changes, empowering you to take proactive steps to shield your identity from harm.

In addition to its monitoring features, the Premium plan provides social network monitoring alerts. This service vigilantly scans social media platforms for any unauthorized use of your name, photos, or personal information. Given that social media accounts are frequent targets for identity thieves, this alert system keeps you informed of potential online fraud attempts.

Among the many benefits of the Premium plan, the most notable feature is the up to $1 million in identity theft insurance it provides. This coverage acts as a financial safety net in the unfortunate event you become a victim of identity theft. The insurance covers expenses associated with restoring your identity, including legal fees, lost wages, and credit repair. This coverage offers invaluable peace of mind, knowing that you have a support system in place to help you recover from the devastating impact of identity theft.

The Premium plan provides a comprehensive array of security features to safeguard adults from identity theft and fraudulent activities. This subscription service offers robust monitoring, timely alerts, and substantial insurance coverage, creating an invaluable layer of protection for your sensitive personal information.

For families with more than one adult, the top-tier Family plan is the best choice. With a monthly cost of $34.99, this plan covers two adults and up to ten children, offering all the features of the Premium plan except for one minor difference.

The assumption of identity theft prevention software that users could have "up to" 10 children is perplexing, particularly given that the average number of children per family in the US is only two, and even fewer in the UK. Despite this, IdentityWorks inexplicably offers pricing options that accommodate up to 10 children and one or two adults. This pricing structure stands in stark contrast to the reality of family sizes in most countries, raising questions about the rationale behind such an assumption.

Unfortunately, annual discounts are currently unavailable. Instead, a brief 7-day free trial is offered. However, it necessitates purchasing the plan and then canceling it within the trial period, effectively converting it into a money-back guarantee during the first week.

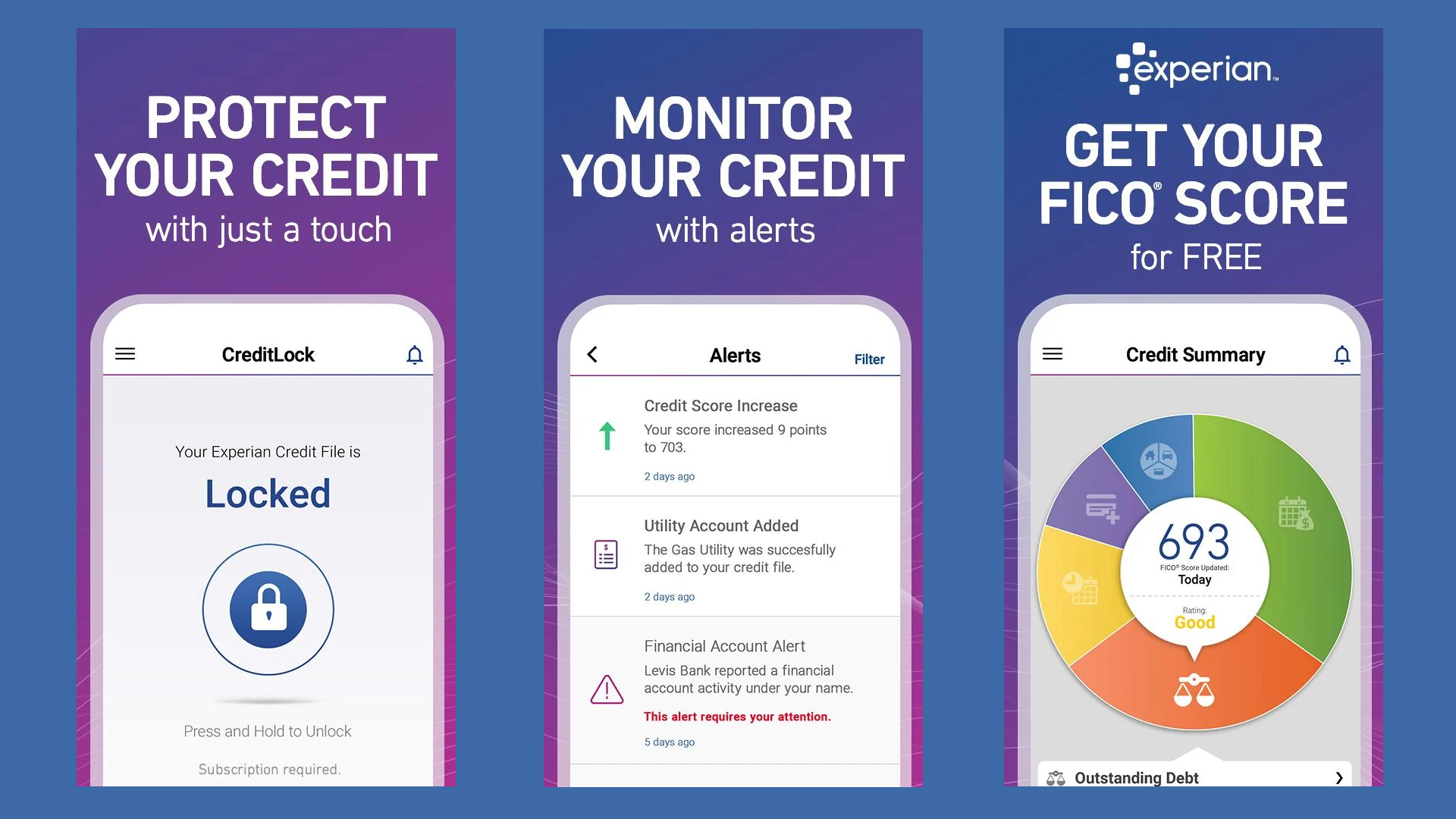

Experian IdentityWorks: Interface

Thank goodness we're partnering with a major corporation like IdentityWorks, which boasts the resources and expertise to develop a user-friendly and feature-rich application. IdentityWorks' dashboard exemplifies minimalist design, featuring a sleek layout with intuitive tabs at the top that simplify navigation. Users can effortlessly find the information they need without unnecessary distractions. Additionally, the dashboard incorporates a dynamic wizard that visually tracks progress, indicating the number of steps completed and accounts configured, much like the seamless experience offered by Norton LifeLock, which prioritizes accessibility and user engagement.

In contrast, PrivacyGuard's interface appears somewhat cluttered, with an overabundance of bright colors that can be distracting and create a sense of overwhelm for specific users. IdentityWorks, on the other hand, cultivates an atmosphere of professionalism and importance, ensuring that users feel confident and secure while managing their sensitive information.

The IdentityWorks app is packed with practical features that empower users to take charge of their identities and maintain their privacy. For example, it offers tools for generating strong passwords, regularly monitoring credit reports, and sending timely alerts about potential identity theft. These proactive measures are crucial in today’s digital landscape, where threats to personal information are constant and evolving. Additionally, the app includes comprehensive resources for identity recovery in the event of an unfortunate need, ensuring users have a plan in place to regain control if their identity is compromised.

Overall, IdentityWorks stands out as an excellent choice for individuals seeking a comprehensive and user-friendly identity management solution. Its clean interface, practical features, and robust security measures position it as a leading option for anyone serious about protecting their identity and privacy in an increasingly digital world.

However, it's worth noting that while the IdentityWorks website provides links to apps for both Android and iOS devices, many consumers are unaware of their actual existence. Unfortunately, the linked apps lead to the Experian app rather than a dedicated IdentityWorks application. This oversight is disappointing and frustrating for consumers who are actively seeking a well-rounded identity management solution tailored to their needs. Improved visibility and clarity regarding app options could significantly enhance the user experience and ensure that users have the necessary tools at their fingertips.

Experian IdentityWorks: Features

In addition to its unique features, IdentityWorks emphasizes the importance of education and empowerment in the realm of identity protection. The platform is designed not only to monitor for potential threats but also to equip users with the knowledge they need to take proactive steps in safeguarding their identities. By providing access to a wealth of educational resources, including articles, guides, and webinars, users can stay informed about the latest trends in identity theft and cyber threats, enabling them to make more informed decisions about their safety.

Another noteworthy aspect of IdentityWorks is its focus on customer support. Recognizing that navigating issues of identity theft can be stressful and overwhelming, IdentityWorks provides comprehensive, round-the-clock support to its users. This includes access to dedicated identity theft recovery specialists who can guide users through the process of resolving any issues they may encounter. Whether it’s disputing fraudulent charges, recovering stolen identities, or simply understanding the nuances of personal credit, having expert assistance available can significantly alleviate the anxiety often associated with identity theft.

Additionally, IdentityWorks places a strong emphasis on user privacy and data security. In an era where data breaches are becoming increasingly common, the platform utilizes advanced encryption techniques and robust cybersecurity measures to safeguard sensitive user information. This commitment to protecting personal data not only enhances trust among users but also aligns with the growing demand for responsible data handling practices in the industry.

Moreover, the ability to tailor monitoring alerts is another feature that enhances the user experience. Users can customize the types of alerts they receive, ensuring they are only notified about issues relevant to them. This level of personalization not only reduces noise and potential overwhelm but also allows for a more focused approach to identity monitoring. Users can prioritize their concerns and receive timely updates that are relevant to their specific situations.

Finally, as technology continues to evolve, IdentityWorks remains committed to staying current with advancements in the field of identity protection. By regularly updating its services and features, the platform aims to stay ahead of emerging threats, offering users cutting-edge tools that reflect the current landscape of identity security. This commitment to innovation not only positions IdentityWorks as a formidable player in the identity theft protection market but also helps reassure users that their security is a top priority in an evolving environment.

In summary, while many identity theft protection services offer foundational monitoring features, IdentityWorks stands out through its unique offerings, emphasis on education and customer support, commitment to privacy and data security, customizable alerts, and dedication to staying current with technological advancements. These qualities make it an attractive option for those seeking comprehensive protection and guidance in navigating the complexities of identity management.

Experian IdentityWorks: The competition

The strong set of features in Experian IdentityWorks includes court record monitoring alongside FICO score simulation accuracy. Still, the identity theft protection market offers multiple robust alternatives for diverse needs and price ranges. LifeLock serves as a prominent identity theft protection service because it is integrated within the Norton 360 suite, which offers comprehensive cybersecurity protection. LifeLock monitors deeply, offering extensive dark web and home title and social media surveillance, along with $3 million in identity theft insurance coverage. However, its costs rise substantially following initial promotional periods.

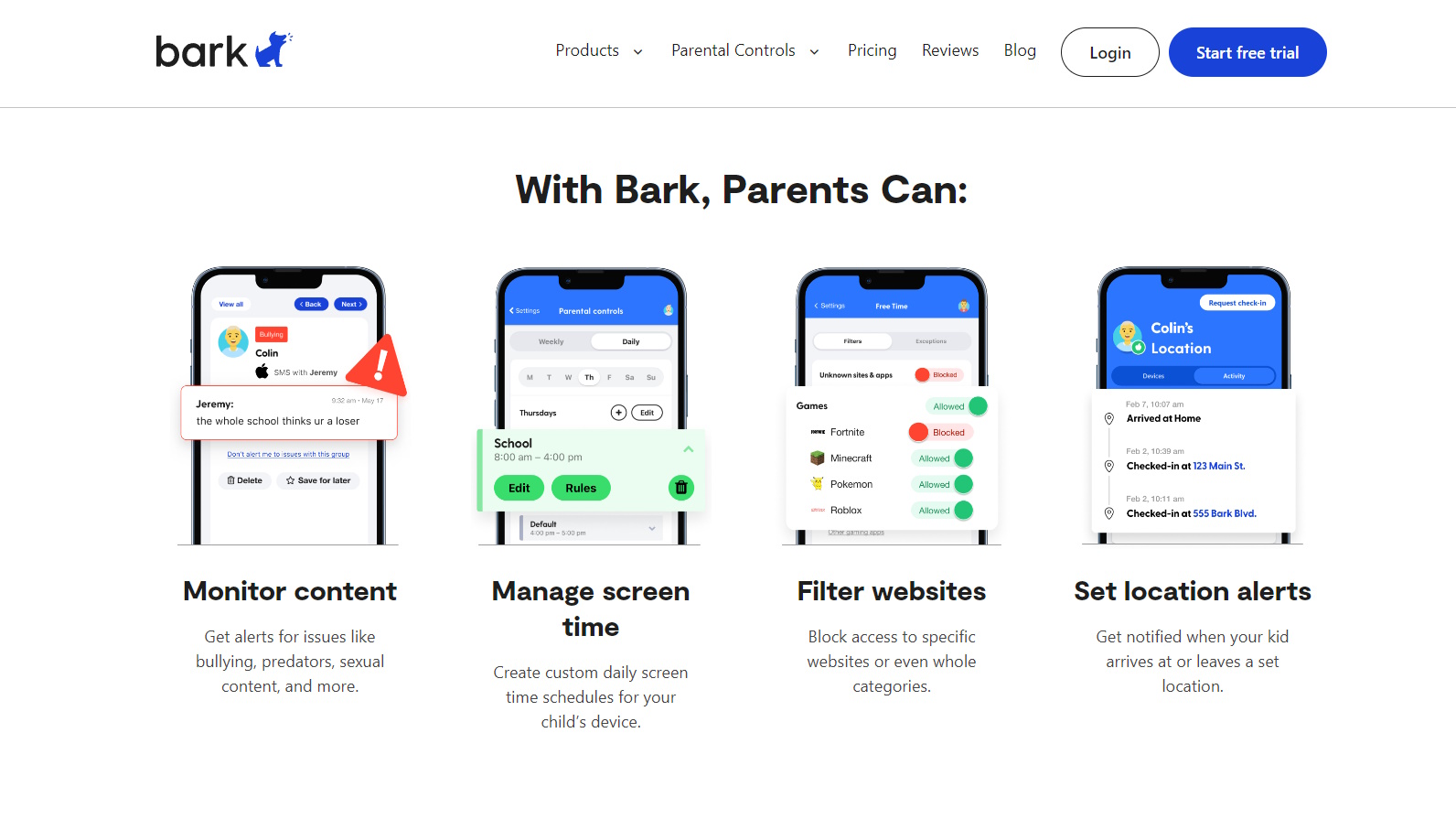

Aura stands as a powerful alternative, achieving high ratings from users who praise its comprehensive security features. Aura provides users with comprehensive identity and credit monitoring capabilities through its alert system, which tracks all three major credit bureaus and incorporates full cybersecurity features, including VPN protection, antivirus software, and parental control capabilities. Aura offers families an excellent digital security solution, providing comprehensive protection at competitive prices with generous identity theft insurance benefits of up to $5 million for family plans.

The Premier version of Identity Guard provides advanced AI technology based on IBM Watson to monitor three bureau data alongside comprehensive protection which sets it apart from other options. The system provides immediate alerts and focuses intensely on credit reporting so it suits users who want to protect their financial information. The legal support feature of IDShield through LegalShield makes it stand out as a provider because it offers simple pricing together with dedicated legal assistance during identity theft situations. The restoration process includes access to a licensed private investigator along with social media tracking and VPN protection for users who need complete identity protection along with robust legal protection. The selection between these alternatives depends on individual preferences regarding specific features and insurance levels as well as budget constraints and the need for a complete cybersecurity package.

Experian IdentityWorks: Support

Experian doesn't provide a specific phone number or email address for direct contact regarding issues. Instead, clicking on "Contact us" directs users to a help center with various articles. For immediate assistance, Experian recommends obtaining an Experian credit report and calling the phone number provided on the report.

To enhance user satisfaction, we would suggest more streamlined and accessible communication channels for users to reach out to Experian.

Experian IdentityWorks: Final verdict

Safeguarding your personal identity stands as an absolute necessity in the current digitally connected world. Our personal information exists in the digital atmosphere to a greater extent than ever because of online transactions and social media posts, along with connected devices. The defense mechanisms provided by credit protection cover only a limited segment of identity theft risks that continue to evolve.

Identity theft is a broad and damaging criminal activity that encompasses multiple types of fraudulent actions, resulting in severe harm to victims. A person who steals your personal details can perform multiple illegal actions, such as establishing unauthorized credit accounts using your name while taking loans you will need to pay, filing false tax returns, and committing crimes, which will appear on your criminal record. The consequences of identity theft go beyond financial damage because they cause severe credit score deterioration along with damaged reputation and both emotional suffering and time-consuming identity recovery procedures.

Experian IdentityWorks stands as one of the primary services that protects identities from theft among all available options. The service provides a comprehensive suite of protective tools designed to defend personal data and mitigate identity theft threats effectively. The service offers continuous credit bureau monitoring, a proactive fraud alert system, substantial identity theft insurance coverage, and dedicated support for resolving identity theft cases.

Many users choose Experian IdentityWorks because of its extensive educational resources and instructional materials. The service provides highly valuable, actionable information that teaches users effective techniques for preventing identity theft and secure methods for handling their data online. The informational materials provide clear and engaging content that enables individuals with varying digital skills to protect their personal information effectively.

The choice to sign up for Experian IdentityWorks depends on personal factors which include your comfort level with risk and the specific issues you want to address. The financial and credit security features of Experian IdentityWorks make it a solid choice for those seeking comprehensive credit monitoring and fraud protection, thanks to its direct connection to Experian's credit data. Direct access to Experian credit data enables users to benefit from superior accuracy and a more detailed understanding.

The past data breach of Experian remains a notable concern for potential customers who decide against the service. The company invested extensive resources in security improvements following the breach more than a decade ago, although the incident continues to impact those who need perfect security standards. People who want better security and peace of mind should consider identity protection services such as LifeLock, Aura, Identity Guard, and IDShield.

We've also highlighted the best identity theft protection